Etsy had their Q4 earnings call this week, and I just wanted to provide a quick overview of the results and interesting points for Etsy Sellers. As expected, gross marketplace sales for Q4 were down year-over-year and therefore so was the GMS figure for the whole year. Etsy managed to post record revenue figures for themselves though. You can watch the earnings call or see the slides and press release here, these reports can include a fair bit of jargon so below is a glossary of terms and acronyms that come up a lot in these calls.

Glossary

- GMS – Gross Marketplace Sales

- EBITDA – Earnings Before Interest, Tax, Depreciation & Amortisation (a measure of profitability from operations)

- Take Rate – percentage Etsy collects in the form of revenue from GMS

- ML – Machine Learning

- LLM – Large Language Model (type of AI, e.g. generative AI, trained on large amounts of data)

- Headwinds – Challenges or negative external factors

- Tailwinds – Positive external factors or influences

- ROI – Return on Investment

- ROAS – Return on Advertising Spend

- BPS – basis points, measures changes in percentages – 1bps = 0.01%

- Currency Adjusted – these are percentage increases or decreases calculated using the previous year’s currency rates to convert non-US dollar marketplace numbers for comparison purposes (the currency adjusted percentages are comparing like for like and not affected by movements in the exchange rate)

Key Financials

- Etsy sales (GMS) were $3.3 billion for the quarter, down 8.3% compared to Q4 2023. For 2024 as a whole, the total was $10.9 billion, down 6% Y/Y.

- The reasons given for this were people having less discretionary spending power and wanting cheap and fast, as well as a shorter Christmas shopping period. Also they started prioritising long term marketing projects over short term initiatives. I would speculate that the US election was a major distraction too, it certainly felt like Q4 took a long time to get going in my shop.

- Consolidated GMS (including Depop and Reverb) in Q4 was $3.7 billion, down 6.8% Y/Y. Consolidated figures were slightly less down than Etsy, offset slightly by strong Depop performance.

- Consolidated Revenue was $853 million, up 1.2% Y/Y – this increase is largely due to services revenue – this was up 8.1%, while marketplace revenue was down 1.4%.

- The marketplace revenue decrease was offset slightly by the new onboarding fees for new shops and expansion of consolidated payments.

- The increase in services revenue was due to increased efficiency of Etsy Ads and being able to deploy more of sellers’ budgets to get the best ROI.

- Adjusted EBITDA was $251 million, up 6.4%

Other Stats of Interest

- Active Buyers on Etsy were 89.6 million, down 1.8% on the previous quarter

- There was talk about re-activating buyers etc, it looks like buyers were down because there wasn’t such a big push in Q4, coupled with people wanting cheap and fast so a cohort of buyers that only tend to buy around the Christmas period failed to be re-activated this year.

- Active Sellers on Etsy were 5.6 million, down 9.7% on the previous quarter

- One reason for this was the new seller onboarding process and fees, which was partly intentional on Etsy’s part, however I don’t think that accounts for such a big drop.

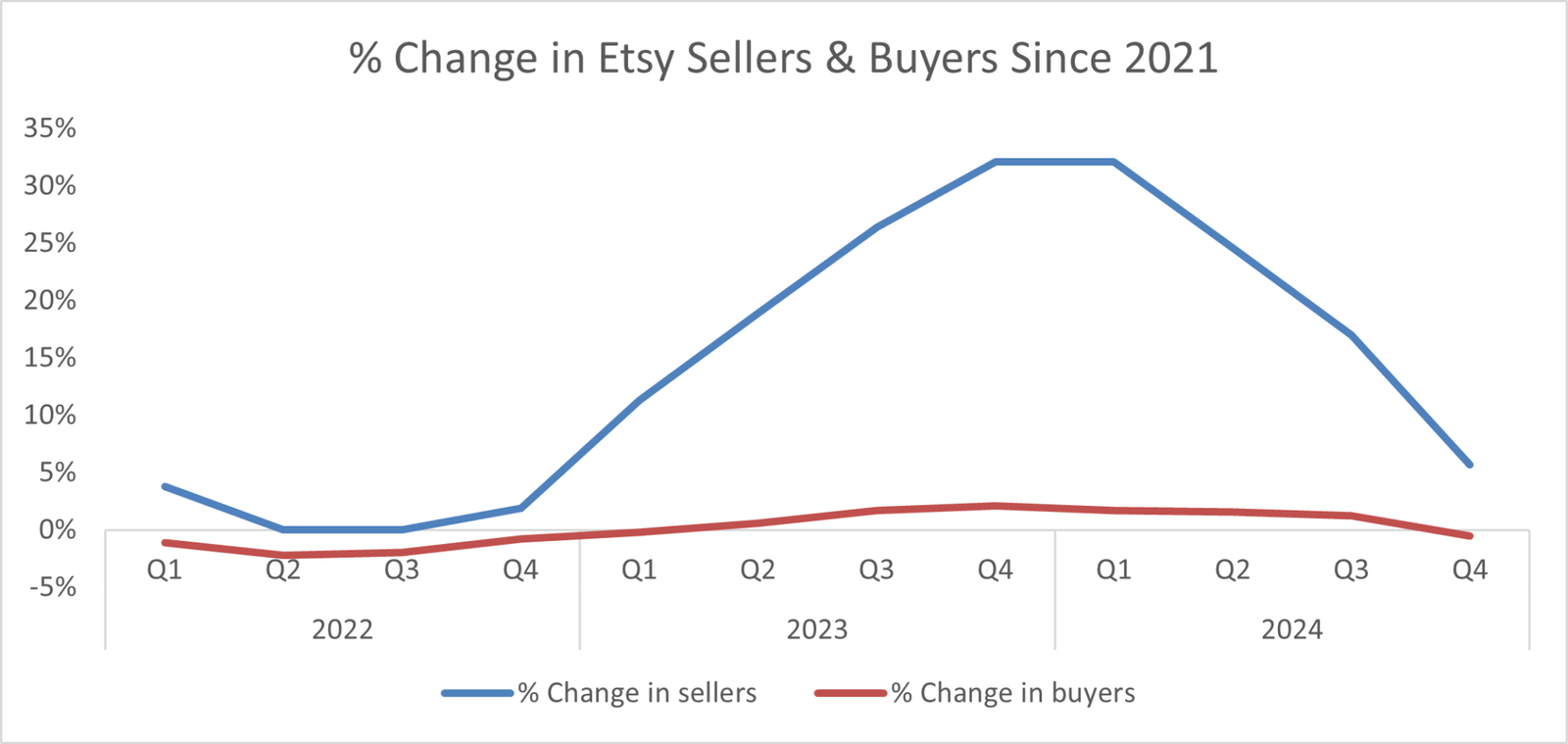

I plotted the graph below out of interest to show the fluctuation in Etsy sellers and buyers relative to the end of 2021. While sellers have remained pretty static, buyers increased rapidly during 2023 and have now dropped off. Note that this shows percentage changes – there are a lot more buyers than sellers, so there is more fluctuation there in actual numbers but sellers have fluctuated a lot more in percentage terms.

- 75% of buyers are in the US and non-US GMS was down more than US GMS due to the macro-economic environment in those geographic areas being more challenging than the US.

- This didn’t surprise me as in my shop, a much higher percentage of my sales were from the US this last year.

- The top categories all declined in the year, however Home & Living fared better than other categories.

- No improvement in outlook in 2025 for at least the first quarter, with GMS expected to be down by a similar amount.

- Part of the reason given was that there was no tailwind from Q4 marketing as they switched their efforts to focus on 2025. Due to this they tried to project optimism about the rest of the year but did not really have any specific reasons other than comparisons getting easier.

Other Talking Points

Differentiation – building on the ‘quality score’, they want to add ‘higher order insights’ such as craftmanship. Apparently AI will be able to tell from our listing photos the level of skill that goes into making the product. This will be incorporated into the search algorithm.

Gifting and Personalisation – they’re continuing with the gifting push and say they’re seeing good results. They say that customers are looking for personalisation and are going to bring in new tools to assist with that.

Marketing – less focus on linear TV and more focus on connected TV (e.g. YouTube and streaming) and paid social.

Tariffs – they were asked a question on the effects of possible tariffs and said it would be hard to speculate as there were lots of different proposals. European tariffs and possible removal of de minimus duty free exemptions were concerns. However they did say they thought they were generally well placed to deal with the current situation as they were less dependent on products from China and most of their sellers sourced their raw materials from within 60 miles of their home.

Etsy app – they are still trying to push buyers on to the app, although there is a bit of friction, they believe the gains outweigh that. They want to increase discovery and inspiration on the app and are revamping their navigation and browsing surfaces. They want to capture lots of data by recording exactly how buyers interact with the app so that they know what to suggest to them in the future.

Seller Survey Stats:

- 8 out of 10 Etsy sellers are women

- 9 out of 10 Etsy sellers are one-person businesses

- Around half sell exclusively on Etsy

- Almost all work from home

Reaction

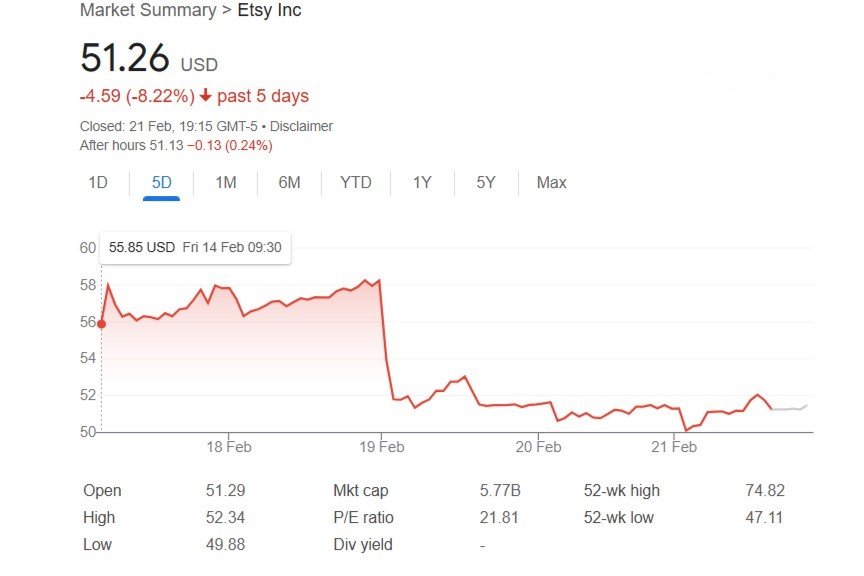

Etsy stock dropped sharply as per the graph below, although could have been worse considering.

Although Etsy were able to redeem themselves somewhat with their revenue figures, the drop in stock shows that investors know this is not sustainable with GMS falling, so hoping Etsy’s efforts pay off and they return to growth soon.

As this post got a bit long, I have split it in two so you can read about the key points and actions for Etsy sellers here.